How AI is Making Retirement Investing Smarter and Safer in 2026: A Real Retiree's Journey

Hey there, folks. If you're nearing retirement or already there, you know it's not all golf games and beach days. It's often a mix of excitement and that nagging worry about money. In this piece, we'll dive into how artificial intelligence (AI) is shaking up the investing world, making it easier for everyday Americans like you and me to build a secure future. We'll follow the story of Peter, a 62-year-old retired government worker from New York City, who turned his retirement jitters into confidence with AI tools. No jargon here—just straightforward talk, real examples, and tips you can use. Whether you're a total beginner or just curious, stick around; this could change how you think about your nest egg.

When Retirement Hits: The Unexpected Worries

Picture this: You've punched your last time card after 35 years on the job. Your 401(k) and Social Security checks are lined up, and you've got about $336,000 saved up—like Peter did. Sounds solid, right? But then reality sets in. Peter, living in the hustle of NYC, started second-guessing everything. "Should I park this cash in a savings account earning peanuts? What if prices keep rising like they did during that inflation spike a few years back? Or worse, what if I dump it into stocks and watch it vanish in the next market dip?"

It's a common feeling. According to financial experts, millions of retirees face this "what now?" moment every year. Peter felt overwhelmed, like many of us do when big life changes hit. He worried about outliving his savings— a fear backed by stats showing the average American retiree spends about 20-30 years in retirement. Add in unexpected costs like healthcare (think Medicare gaps that can run thousands annually), and it's no wonder peace of mind feels elusive.

The Tough Choices Every Retiree Faces

Peter chatted with buddies over coffee—classic New Yorker style. One swore by flipping houses in upstate New York, another pushed crypto like it was the next gold rush, and his sister raved about mutual funds. Sound familiar? We've all gotten that mismatched advice from well-meaning folks. But here's the rub: Human tips are often colored by personal wins (or losses). Your uncle who struck it rich in tech stocks might forget the dot-com bust of the early 2000s.

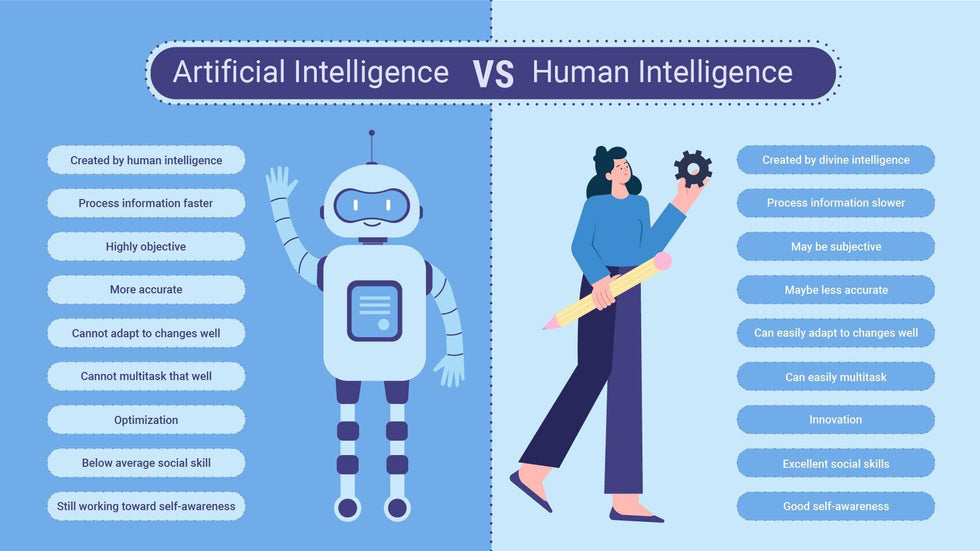

This scattershot approach leaves retirees vulnerable to common pitfalls, like chasing hot trends without a plan. For instance, during the 2022 market slump, many pulled out in panic, locking in losses they couldn't recover. Peter realized he needed something unbiased—enter AI. It cuts through the noise by crunching data from thousands of scenarios, not just one person's story. If you're facing similar dilemmas, check out resources like the U.S. Securities and Exchange Commission’s guide on retirement planning for basics, or our internal post on avoiding common retirement scams.

Demystifying AI-Powered Investing: What It Really Means

Okay, let's break it down simply. AI-powered investing isn't some sci-fi robot taking your money—it's smart software that sifts through mountains of data to guide your choices. Think of it like GPS for your finances: It looks at stock trends, interest rates from the Fed, inflation forecasts, and even global events like trade tensions with China.

Unlike a human advisor who might overlook details after a long day, AI never sleeps. It spots patterns humans miss, like how bonds performed during the 2008 recession. For beginners, this means no more guessing—AI calculates probabilities based on facts. Plus, it's efficient: Tools can forecast scenarios in seconds, helping you avoid overpaying taxes or missing growth opportunities. As one benefit, it personalizes advice, tailoring plans to your life stage—super handy for retirees watching every dollar.

Why AI is a Game-Changer for New Investors and Retirees

If you're new to investing or in your golden years, AI shines brightest. Peter's top worries? Keeping his money safe, beating inflation (which averaged around 3% lately), and growing it steadily without wild swings. AI tackles these by focusing on risk control—think automated alerts if markets wobble—and balanced mixes that won't tank your savings.

Take real-world perks: AI boosts accuracy in budgeting, spotting ways to cut costs like unnecessary subscriptions (hello, streaming services overload). It also personalizes— for a low-risk retiree like Peter, it might suggest more bonds and ETFs tied to stable giants like Apple or Walmart. Avoid mistakes like not diversifying, which burned folks in the GameStop frenzy. For more on benefits, peek at NerdWallet's take on AI tools. And internally, read our guide to AI gadgets for everyday finance.

My Hands-On Experience with an AI Advisor

Peter jumped in with a popular platform (we'll get to recommendations later). He plugged in basics: Age 62, retired, $336,000 pot, monthly bills around $4,000 (NYC rent isn't cheap), low-medium risk appetite, and inflation fears. Boom—in moments, out popped a custom plan. No sales pitch, just logic: "Allocate 40% to bonds for stability, 30% to stocks for growth, and keep 10% cash for emergencies."

It felt trustworthy, like chatting with a savvy friend who knows the numbers. Peter appreciated how it explained everything plainly, even simulating "what if" scenarios like a healthcare bill spike.

Breaking Down How AI Crafts Your Investment Strategy

Here's the step-by-step magic, expanded with tips:

- Assessing Your Risk Comfort: AI quizzes you on tolerance—Peter's age meant dialing back aggression to avoid losses like those in the 2020 COVID crash.

- Spreading It Out (Diversification): No eggs in one basket. Peter's plan split across stocks (e.g., S&P 500 trackers), bonds (government-safe), ETFs (low-fee baskets), dividend payers (steady income like utility companies), and cash. This cushioned against sector slumps, like tech's 2022 dip.

- Battling Inflation: AI picked assets that historically outpace rising costs, like real estate investment trusts (REITs) mirroring U.S. property booms.

- Eye on the Long Haul: For 15-20 years ahead, it aimed for 4-6% annual growth, realistic post-inflation, avoiding get-rich-quick traps.

Keeping Risks in Check: AI's Superpower

People often flop by panicking—selling low during downturns like the 2008 crisis or buying high on hype. AI stays cool, using history (e.g., how markets rebounded after 9/11) and models to predict and adjust. It automates rebalancing, saving you from emotional blunders that cost retirees dearly.

Beyond Borders: How AI is Helping Worldwide

Peter's story isn't unique. Globally, AI levels the playing field. Take Sarah, a teacher in rural Texas—she used AI to dodge shady local schemes and build a family fund. Or in Europe, retirees battle low rates; AI optimizes across borders. In the U.S., it's booming with apps handling everything from IRAs to taxes. For global insights, see Brookings' report on AI in finance.

Why Old-School Advice Might Not Cut It Anymore

Traditional advisors? Great, but limited by bias or sales quotas. They might push high-fee products, ignoring full data. AI flips this—fact-based, low-cost. Big banks use it behind scenes; now you can too. Common mistake: Ignoring scams targeting retirees, like fake investment pitches. Stay sharp with our scam prevention tips.

AI vs. Traditional Advisors: A Quick Comparison

| Feature | Human Advisor | AI Advisor |

|---|---|---|

| Emotion-Free Decisions | ❌ | ✅ |

| Data Crunching Power | Limited | Massive |

| Always Available | ❌ | ✅ |

| Cost | High | Low |

| Consistency | Variable | Stable |

AI wins on efficiency, but hybrids (AI + human) are ideal for complex needs.

Why Everyone's Talking About AI Investing in 2026

Searches for "AI retirement planning" are skyrocketing—folks want data-backed security amid economic shifts like rising rates. Platforms like Betterment and Wealthfront lead, offering robo-advice for beginners. It's trending because it democratizes wealth, especially post-pandemic when remote tools exploded.

Your Starter Guide to AI Investing

No tech degree needed:

- Pick a trusted platform like Betterment or Vanguard Digital Advisor.

- Enter honest info—age, goals, income.

- Review suggestions; start small.

- Check in quarterly; let AI tweak.

Pro Tip: Treat AI as Your Smart Sidekick

AI isn't a crystal ball—use it to learn, not gamble. Combine with common sense, like diversifying beyond one app. It reduces risks but can't predict black swans like pandemics.

Let's Chat: Share Your Thoughts

Ready to dip your toes? Subscribe to our newsletter for more on AI finance, smart tools, and wealth strategies. Tried AI investing? Drop a comment below—we'd love to hear your wins (or lessons learned).

Wrapping Up: From Worry to Winning

Peter went from anxious to assured. AI didn't do the thinking for him—it supercharged it with data. For U.S. retirees facing healthcare costs or market volatility, it's a lifeline to that elusive peace. Remember, smart investing beats luck every time.

Frequently Asked Questions (FAQs)

- What is AI-powered investing? It's using smart algorithms to analyze data and suggest investment plans, removing human bias for better decisions.

- Is AI safe for retirees? Yes, it emphasizes risk management and diversification, but always use reputable platforms and consult pros for big moves.

- How much does AI investing cost? Many tools are low-fee (0.25% or less annually), cheaper than traditional advisors charging 1-2%.

- Can beginners use AI tools? Absolutely—they're user-friendly, with simple interfaces and explanations.

- Does AI replace financial advisors? No, it complements them. Use AI for routine planning, humans for personalized life advice.

- What are top AI platforms in 2026? Betterment, Wealthfront, and Vanguard Digital Advisor are popular for retirees.

- How does AI handle market crashes? It uses historical data to rebalance portfolios automatically, avoiding panic sales.

- Is my data secure with AI apps? Reputable ones use bank-level encryption; check for FDIC insurance on cash portions.

- Can AI help with taxes in retirement? Yes, many optimize for tax efficiency, like harvesting losses to offset gains.

#RetirementPlanning

#AIFinance

#RoboAdvisor

#FinancialFreedom

#AI2026

#RetireSmart

#WealthBuilding

#FinTech

#PersonalFinance

No comments:

Post a Comment